After a crazy rise since November, the market is panicking. And for good reason, the liquidations are quite significant, and the price of Bitcoin has fallen well below the psychological threshold of $100,000. However, BTC is falling with less intensity than during previous cycles. Isn’t this correction normal after such an increase? Let’s take a step back and analyze the Bitcoin and cryptocurrency situation in today’s newsletter!

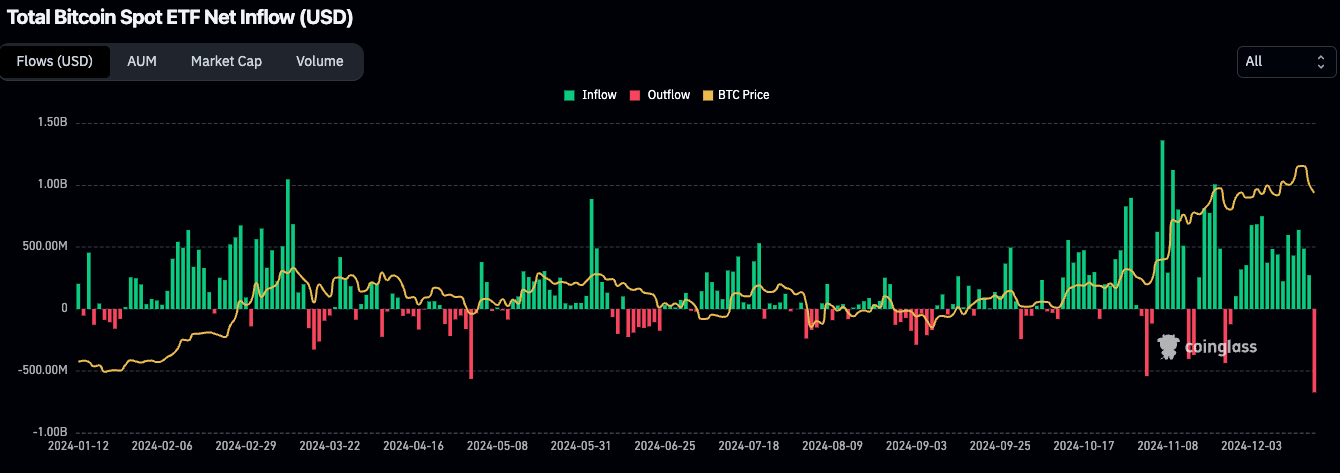

Bitcoin ETF Panic With Biggest Outflow Since Launch

The cryptocurrency market clearly was shaken by J. Powell’s speechthe chairman of the Fed. The effect was immediate on the Bitcoin Spot ETF, as we can see the biggest release since the launch earlier this year. December 19 actually happened ETF outflows of $670 million :

This day ends 15 days in a row in green and almost $7 billion in inputs. It is therefore important that take a step back on the situation. Actually, 670 million dollars are not negligible but demand for ETFs remains very high overall. When it comes to cryptocurrency performance, we have more or less the same observation.

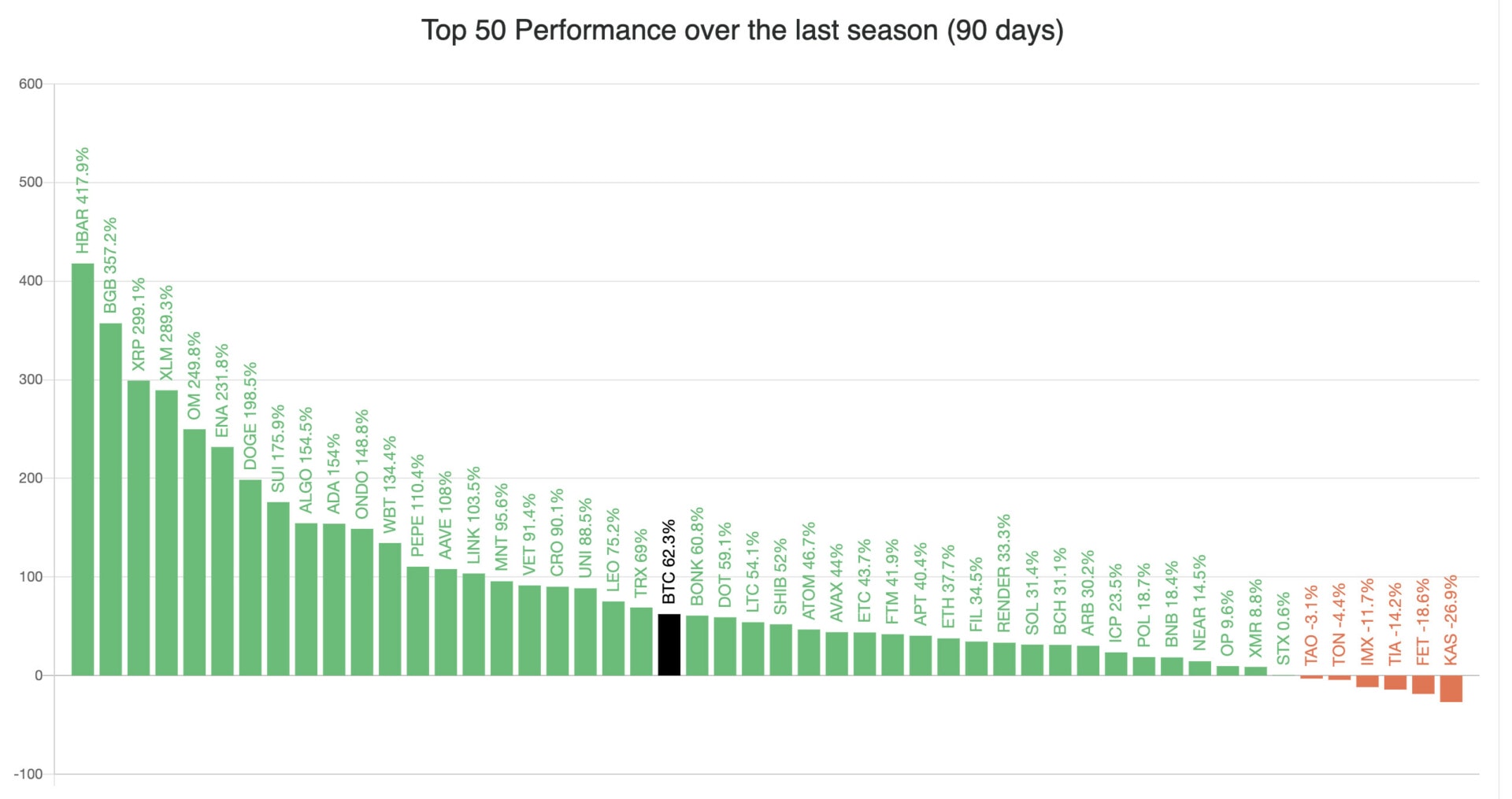

The market is correcting, but bitcoin and altcoins are performing well in the last 90 days

Certainly not the price of Bitcoin reached $110,000and sellers managed to produce drop the price below $95,000. But you must know take a step backbecause despite the arrival of institutional players (ETFs), the cryptocurrency market remains unstable. And if we take Top 50 Cryptocurrenciesthe situation is like this far from catastrophic over the past 90 days :

Only in the top 50 6 altcoins show red in last three months. Bitcoin is growing approx 60%and they exist many altcoins outperform it. THE XRP is part of the top 3 performing assets and the remaining two are HBAR (420%) a BGB (360%). Ethereum (ETH) performs less well than Bitcoinbut remains more than 35%.

Even if dominance has declined in recent weeksIt seems that the altcoin season is not over yet. We see this when we compare the metrics to 2021.

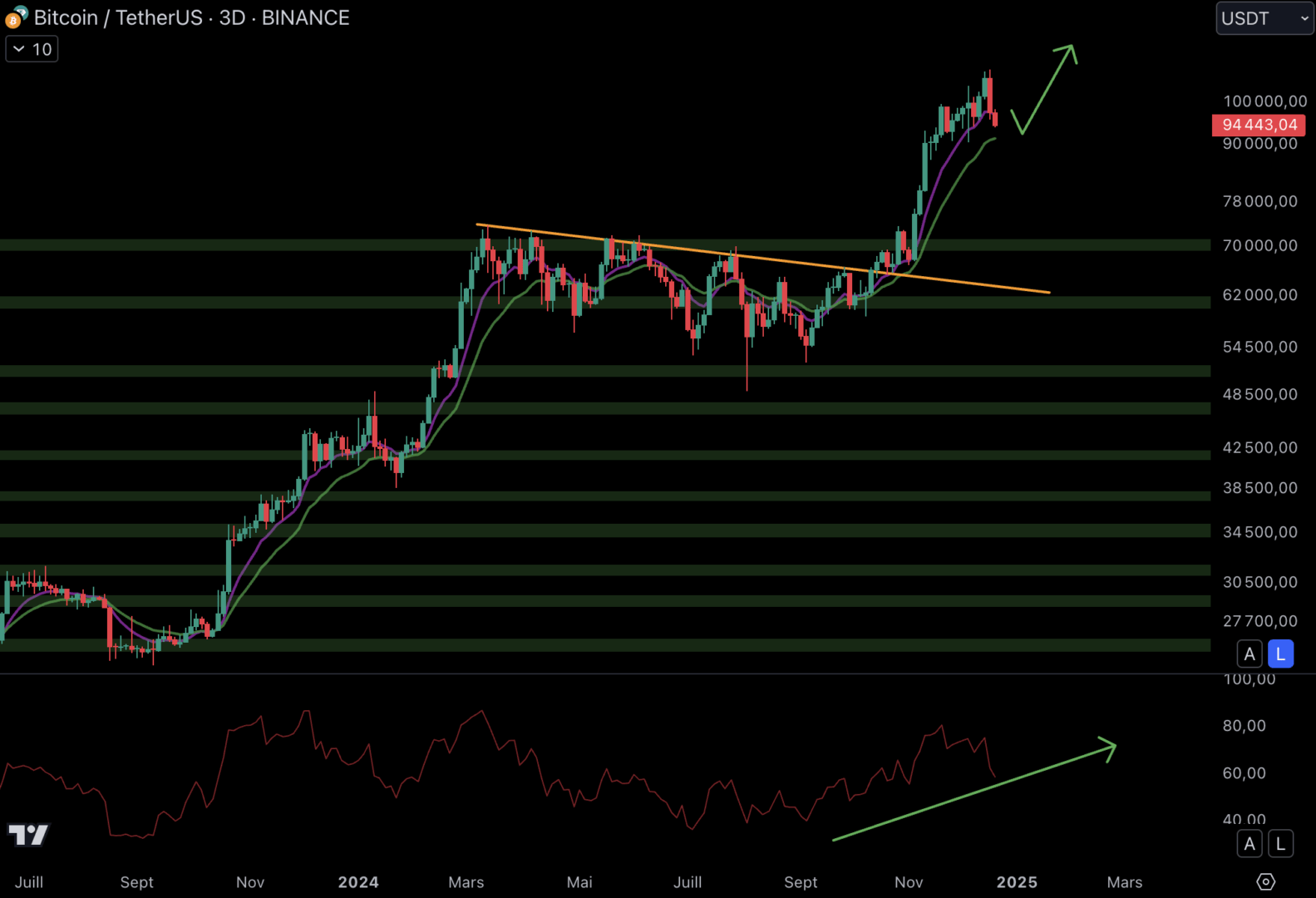

BTC price is falling, but is a comeback possible?

The cryptocurrency king recorded a local top around $108,000. And it’s entirely possible that it does highest in 2024. If investors had asked this in January, they would have he signed knowing that BTC would trade around $100,000 at the end of the year. The course is in process repairand is back on level institutional bias (EMA 9/EMA 18) bullish in 3 days :

AND bounce on bullish moving averages it is quite possible, as was already the case in October, November and December. On the other hand, if moving averages do not allow for a rebound, it does not exist no fixed support before $70,000. Despite the fall, RSI always shows ascending lows and highs. THE thus buyers are in control of the momentum.

Cryptocurrencies are going through a difficult period after several weeks of growth. We need to stay on top of things because Bitcoin’s technical situation is still far from a tragedy. Altcoins are experiencing significant retracements, but the largest market caps remain mainly in the red over the past three months. Additionally, Bitcoin continues to break records…