Bitcoin and cryptocurrencies are comfortably installed in a bull market, the price behaves as in previous bull runs. BTC even has the luxury of outperforming the bull run from 2015 to 2018. And yet the Fed speech cooled the mood. J. Powell, the chairman of the Fed, has made it clear that no BTC will be held at the Fed. And the threats don’t just come from the Federal Reserve. Let’s take a look at some of the threats looming over cryptocurrencies!

- Bitcoin and cryptocurrencies have been having a good time, even surpassing the 2015-2018 bull run, but the Fed’s speech raised concerns.

- Uncertainties surround potential US regulations and the role of the dollar index, threatening the stability of the cryptocurrency market.

Beware of having too high expectations for Bitcoin

The cryptocurrency sector has been experiencing a prosperous period. Verification has occurred and launch of spot ETFsPUSH rate cuts by the Fed (theoretically bullish) athe election of Donald Trump. In addition, we see that there are more and more states that they are thinking about creating a strategic reserve in BTC. This is especially true for Japan. Wouldn’t investors be a bit too used to good news ? AND disappointment could do about certain subjects shake up the marketwe saw this with J. Powell’s speech on December 18th.

The Fed has already expressed this through its president rate cuts could be lower than expected. This has already resulted in Bitcoin and altcoins are fallingand there is nothing to say that the discourse could be settled in 2025. After that, operators expect that The United States is introducing more favorable regulation for cryptocurrencies. Some even hope so strategic reserve in BTCwhich would result in a FOMO from other states. But what if that journey takes—a lot— more time than expected ? What if D. Trump and his teams focused on other priorities before you get interested in cryptocurrencies?

We know the market doesn’t like it uncertaintyand these various elements could cool investors.

The dollar: the surprise guest that BTC and cryptocurrencies did not expect?

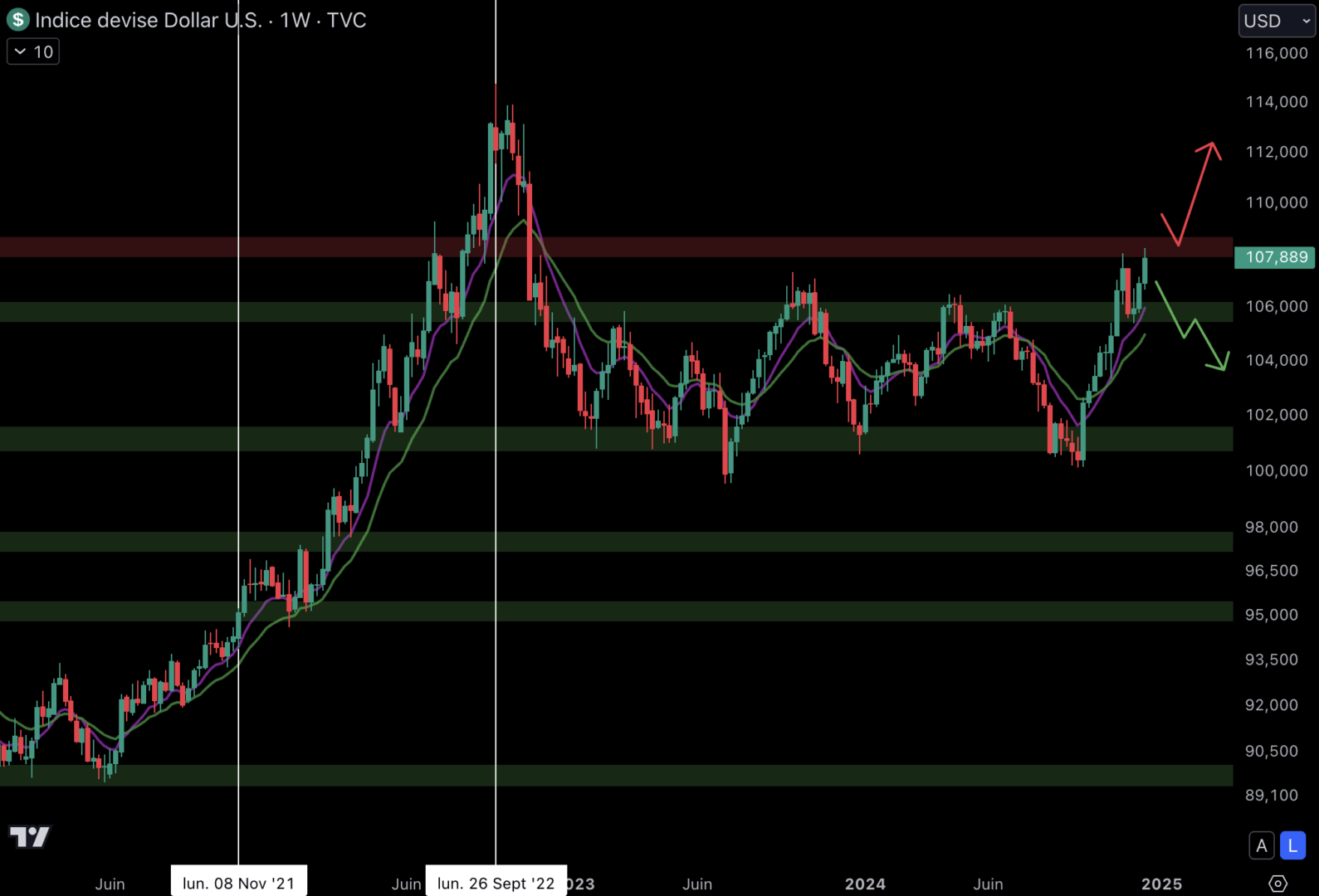

THE dollar index it is interesting to analyze to know if cryptocurrencies – and risk assets in general – can to perform. In November 2021, when the dollar was getting strongerBTC and cryptocurrencies entered a a bearish phase called a bear market. And because the dollar index recorded a peak in September 2022THE sector is much better off :

After a long lifethe dollar is trying to do that get out of reach andacceleration towards September 2022 highs. The period during which the dollar is strong could jeopardize the chances of having a altcoin season For example. This chart will be worth watching closely in the coming months, and we must I hope the dollar is closer to the top of the marketthat for bullish continuation.

For several months now, operators have been used to bullish events that cause the price of Bitcoin to rise. But will 2025 be another positive year with the announcement of strategic reserves in BTC and another rate cut? It’s hard to say, but we’ll have to keep a close eye on the dollar, which is starting to seriously threaten Bitcoin and cryptocurrencies. If these threats can be averted, the sector could continue its momentum, especially as some indicators inspire optimism.