All investors are looking for the perfect indicator to know when Bitcoin will reach its market peak. The first article was written listing 3 indicators that allow – historically – to estimate that Bitcoin is at the end of its cycle. These are three indicators that have proven themselves over various cycles, and we will introduce three more. Here are three metrics you can add to your must-have list to predict Bitcoin market peaks and refine your investment strategies.

NUPL: indicator to identify participants’ euphoria

We will not go into details NUPL (Net Unrealized Profit/Loss)because a complete article has already been written about it. In short, it is a indicator on the chain which allows to measure market sentiment of operators. When the indicator is above 0is that investors are profitable. On the other hand, when the indicator goes to red (surrender/less than 0), operators are at a loss. Plus it’s when the market is euphoric (blue) that Bitcoin is hitting market highs :

All times the metric was active euphoria zonethe market installed a up. However, in 2021, the NUPL indicator bordered on the euphoria zone. If the metric returns above 0.75 (euphoria)it will probably be necessary to think seriously take profits. At the moment, the indicator is developing in belief zone (green) andeuphoria is not current yet. But that could change in the coming weeks or months.

2-year MA multiplier: a simple but effective indicator

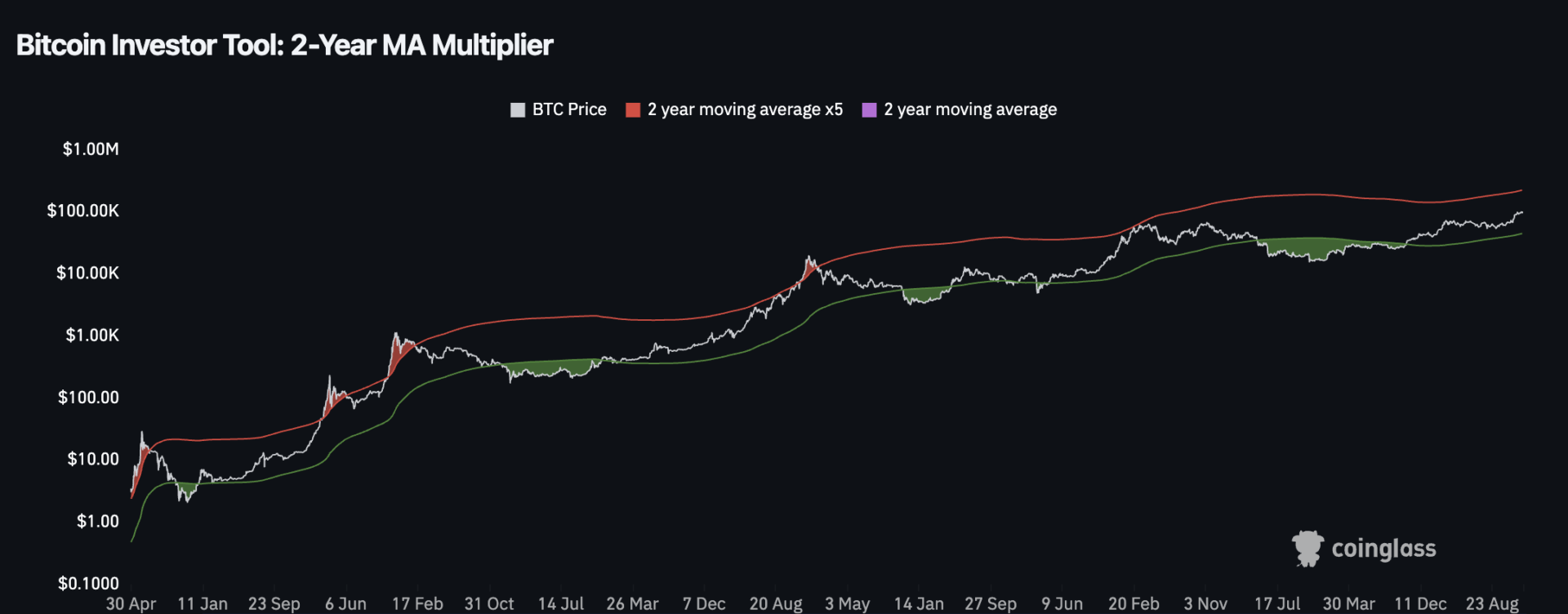

THE 2-year MA multiplier is a structurally simpler indicator than NUPL, but it is the same effective. The basic indicator is constructed with two moving averages :

- AND two-year moving average (green) : when the price falls below, it is considered to be underrated. Investments within this line made it possible very attractive return on investment yet.

- THE multiple of 5 two-year moving average (red) : this line lets you know when BTC is overheating. You must be be careful when entering this bend.

Like NUPL, the 2-year MA has the multiplier right relative to the market tops, with the exception of 2021 when the price approached the red curve. However, keep in mind that when the price approaches 5x the 2-year moving average, the market becomes increasingly hazardous.

200 Period Weekly Moving Average: Compass for Bitcoin Price?

The following indicator is similar to the previous one as it uses a moving average. Here we have 200 period weekly moving average (red). However depending on the location of the price in relation to this moving averagewe can estimate What phase is the cycle in? :

When the indicator goes to green, yellow, orange or redthat means that the cycle is advanced. And the closer the color redthe more so the market is overheating. This indicator has always worked very well until now and it also allows you to do this determine when BTC is undervalued. In fact, BTC is undervalued is close to a moving averageor when it passes below that.

All of the above indicators have historically been very effective. Of course they could be wrong. However, by combining these indicators with other metrics (on-chain, technical, sentimental), we can refine our analyzes and better predict market developments. However, be careful not to follow these pointers blindly. Because the market is changing and some indicators could become obsolete sooner or later.